COMPLETE LLC FORMATION START TO FINISH

Starts at $0 + state fees and only takes 5-10 minutes

Learn How to Start an LLC first.

starter

Standard

Covers all your required filings with the state, 100% accuracy guaranteed.

+ state fees

pro

Most Popular

Fastest processing with ongoing state compliance and EIN set up.

+ state fees | renews at $199/yr

premium

Best Value

Advanced compliance and registered agent services to meet all requirements.

+ state fees | renews at $399/yr

*Processing times are based on receiving complete information. ZenBusiness processing times do not include Secretary of State processing times, which can vary.

† SPECIAL OFFERS – By keeping the box(es) selected, you agree to the offers in your package. After the initial period ends, these services automatically renew at their regular price. You can cancel these services at any time before or after the introductory period ends.

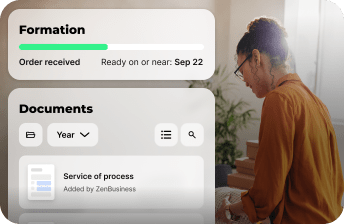

Choose the LLC formation package, registered agent and compliance services, and filing speed that fits your needs.

Our team of formation experts securely file your LLC with the state – all backed by our 100% accuracy guarantee.

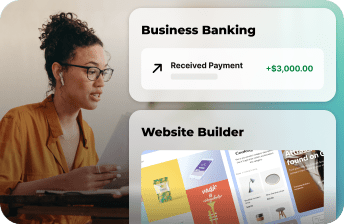

Use personalized AI and resources to add tools for business banking, bookkeeping, and establishing your business online.

We manage the details so you can focus on what you love. See how our platform works.

We manage the details so you can focus on what you love. See how our platform works.

Our all-in-one platform provides the services, tools, and resources you need to be successful.

Our AI assistants and tools provide personalized guidance during every step of your business journey.

Award-winning customer support and our expert-led Blueprint for Success and on-demand education series.

We’re socially conscious and committed to helping people from all walks of life with programs for social impact and small business grants.

“The exciting thing about having your own business is realizing how much opportunity there is.”

– Marisa Byrne

Ready to start your LLC?

Enter your desired business name to get started

ZenBusiness provides an LLC service that helps entrepreneurs form a limited liability company (LLC) online. We manage the required paperwork, ensure quick and accurate filing with the state, and provide ongoing compliance and business management services.

The time to create an LLC with ZenBusiness depends on your state’s processing speed, but your ZenBusiness package also affects how quickly your filing is processed on our end.

The state’s turnaround time varies by state and time of year, and ZenBusiness cannot change how fast the Secretary of State approves filings. What we can control is how quickly we prepare and submit your paperwork once we have all your information.

With our Starter Package, ZenBusiness typically processes your LLC filing in about 7–10 business days. With our Pro and Premium Packages, ZenBusiness provides 1‑day processing for your LLC filing.

All processing times are based on receiving complete and accurate information and do not include the state’s own processing time.

The cost of starting an LLC with ZenBusiness depends on which package you choose and the state filing fees for your LLC.

Starter Package: Starts at $0 plus state fees. It includes a business name availability search, preparation and filing of your articles of organization, electronic document access, a personalized dashboard with unlimited storage, our 100% accuracy guarantee, Worry‑Free Compliance free for the first year (renews at $199 per year), lifetime support, compliance alerts, access to Velo AI assistant, our mobile app, partner offers from Bank of America, 1‑800Accountant, and Next Insurance, and a 30‑day trial of website, domain, and email tools (renews at $15 per month). Processing typically takes 7–10 business days, with an option to add rush processing for $79.

Pro Package: Starts at $199 plus state fees. It adds 1‑day processing, an operating agreement template, an EIN, a logo builder, and a free quote from Next Insurance. Pro renews at $199 annually.

Premium Package: $399 plus state fees, and renews at $399 annually. It includes all Pro Package services plus business document templates, registered agent service, Advanced Compliance Protection, a business advisor consultation, and a 60‑day trial of ZenBusiness Money Pro (renews at $30 per month).

The cost to form an LLC with ZenBusiness includes your state filing fees plus the ZenBusiness package price and any optional add-ons you choose.

State filing fees are set by each state and are paid in addition to any ZenBusiness package price.

ZenBusiness offers three main LLC formation packages:

Starter Package: Starts at $0 plus state fees. It includes the preparation and filing of your formation documents, our 100% accuracy guarantee, Worry‑Free Compliance free for the first year, access to Velo (our AI business assistant), your personalized dashboard for document storage, lifetime customer support, compliance alerts, our mobile app, partner offers to help you manage and grow your business, and a 30‑day trial for website, domain and email (renews at $15 monthly).

Pro Package: Starts at $199 plus state fees. Adds 1‑day processing, an Operating Agreement Template, EIN, logo builder, and a free quote from Next Insurance. Pro package renews at $199 annually.

Premium Package: $399 plus state fees, renews at $399 annually. Includes Business Document Templates, registered agent, Advanced Compliance Protection, a business advisor consultation, and a 60‑day trial of ZenBusiness Money Pro (renews at $30 monthly).

Optional add-on services, such as an operating agreement template, business document templates, registered agent, EIN, logo kit, website/domain/email tools, and ZenBusiness Money Pro, may add extra costs depending on the package you select and your specific needs.

Yes. You can cancel your ZenBusiness subscriptions or add-on services, and refunds may be available if you are within our refund window.

If you wish to cancel a subscription or add-on service and request a refund, please review our official refund policy at /support-terms/#refund-policy. That page explains which purchases qualify for a refund and the time limits that apply.

You can still cancel your subscription or service after the refund window has passed, but a refund will generally not be issued.

ZenBusiness LLC formation packages include different services depending on whether you choose the Starter, Pro, or Premium package.

Starter Package: Starts at $0 plus state fees. It includes a name availability search, preparation and filing of your articles of organization, electronic document access, a personalized dashboard with unlimited storage, our 100% accuracy guarantee, Worry-Free Compliance free for the first year (renews at $199 per year), compliance alerts, access to Velo AI assistant, our mobile app, partner offers, lifetime support, and a 30-day trial of website, domain, and email tools (renews at $15 per month).

Pro Package: Starts at $199 plus state fees. It includes all Starter Package services, 1-day rush processing, an operating agreement template, an EIN, a logo builder, and a free quote from Next Insurance. The Pro Package renews at $199 annually.

Premium Package: $399 plus state fees, renews at $399 annually. It includes all Pro Package services, business document templates, registered agent service, Advanced Compliance Protection, a business advisor consultation, and a 60-day trial of ZenBusiness Money Pro (renews at $30 per month).

Yes, you can change your LLC name after it has been formed by filing an amendment with your state.

ZenBusiness can help you with this through our amendment filing service or through Worry-Free Compliance, which is included in Pro and Premium packages, and free for the first year with Starter package.

To add a member to your LLC, you will need to file an amendment with the state and update your operating agreement.

Yes, ZenBusiness can act as your registered agent, but you will need to sign up for the registered agent service and provide the necessary information.

No, you do not need to have a physical address in the state where you’re forming your LLC, but you will need to provide a physical address for the registered agent.

State Guides for LLC Formation

Check out our comprehensive guides tailored to each state's LLC formation laws and processes.

Get your LLC formation package with everything laid out upfront. No hidden fees. See exactly what’s included at checkout. Packages start at $0 plus state fees.

Name Availability Search

We confirm your business name is available in your state before you file.

Formation Documents

We prepare and file your Articles of Organization with the state to officially create your LLC.

Registered Agent Service

We can receive legal mail on your behalf and keep you compliant (required in every state).

Tax ID (EIN) Filing

We can file for your EIN with the IRS so you can open a bank account and hire employees.

Operating Agreement

We can provide a customizable operating agreement template to help you define ownership and protect your personal assets.

Banking Resolution

We can provide the banking resolution document you need to open your business account.

Join over

850,000+

small business owners

Starts at $0 plus state fees and only takes 5 to 10 minutes