By Sasha Douglass

According to reports, the global factoring industry showed an annual growth last year of 5%, reaching a net worth of €2.9 billion. The highest growth in the sector was seen in Europe, which experienced more than an 8% industry increase.

There are many reasons for the steady growth of the factoring industry. Invoice factoring offers businesses a unique opportunity to improve their cash flow, protect their bottom line, and render themselves more competitive.

However, if you would like to take advantage of the benefits of invoicing factoring, it is important to know the difference between recourse vs. non-recourse factoring. Once you do, you can make an informed decision as to which is most advantageous for your business.

Ready to learn more about non-recourse factoring and what it can offer? If so, keep reading as we unpack how this popular cash flow financing method works.

What Is Non-Recourse Factoring Coverage?

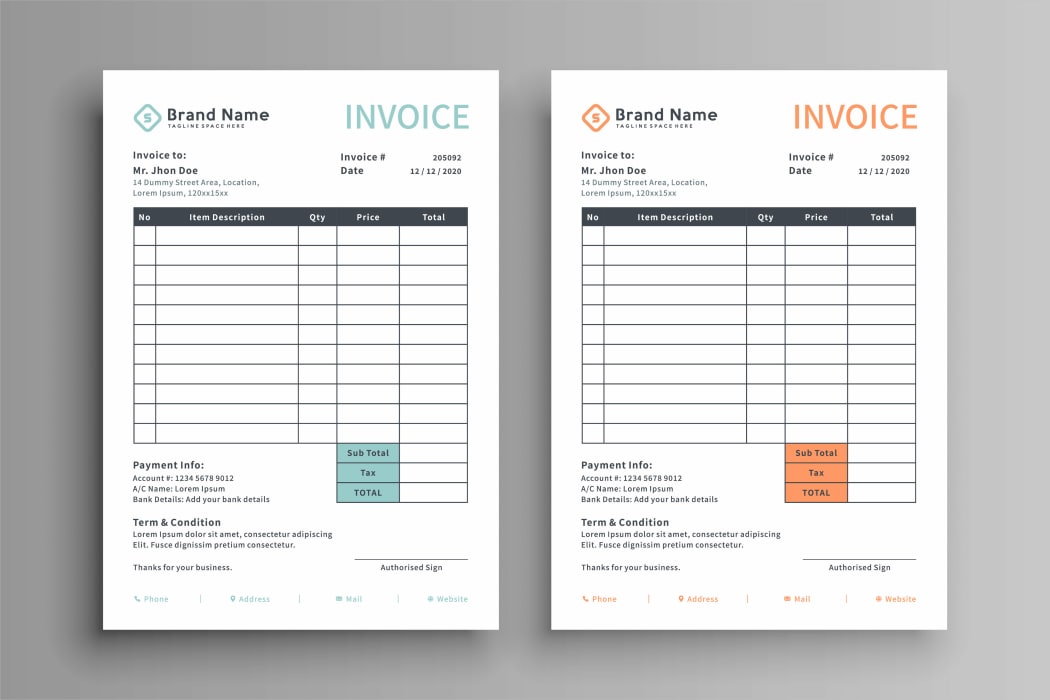

To understand what non-recourse factoring is, let’s quickly take a look at what factoring itself is. Factoring is the practice of selling one’s accounts receivable to a third party, at a discount, or for a fee. The third party then collects on the receivables.

This is also known as invoice factoring.

There are two primary types of invoice factoring. Recourse factoring and non-recourse factoring.

Recourse vs. Non-Recourse Factoring

The differentiating factor between recourse vs. non-recourse factoring is who assumes the liability of unmet invoices.

With recourse factoring, any invoices that are not collected by the factor (the company purchasing the accounts receivable) are bought back by the business selling them. This means that the seller assumes the liability for any unmet invoices.

Non-recourse factoring works the opposite way. Unmet invoices do not have to be bought back by the seller. Instead, the factor assumes responsibility for these. Depending on the agreement between the factor and the seller, there may be some circumstances where the factor is not responsible.

However, in most cases, factors assume liability for all instances where unmet invoices are caused by insolvency and bankruptcy. Because non-recourse factoring places liability on the factor, fees for non-recourse factoring are generally higher than for recourse factoring.

How Non-Recourse Factoring Works

When a business wishes to apply for non-recourse factoring, it will typically submit applicable information regarding their accounts receivable to a potential factor. The factor will then determine which accounts they wish to purchase, based on things such as the credit history of the account holders.

Because non-recourse factoring poses an enhanced risk for factors, they are usually more discerning around which receivable accounts they wish to take over. Once the factor has approved the accounts they are able to purchase, the transaction takes place.

A percentage of the value of the accounts receivable minus the factor’s fee is then released to the seller within a certain time period. This can vary depending on the factor. The upfront percentages can also vary, however they generally start at 85%. A competitive non-recourse factoring company may offer upfront percentage payments as high 90%.

Once the factor has collected the accounts, they will then pay the seller the outstanding percentage. If any of the accounts were not met for reasons that the factor does not take responsibility for, the factor may retain a portion of this final payment in order to cover the loss.

Benefits of Non-Recourse Factoring

Factoring offers businesses a number of valuable benefits. What’s more, besides the general advantages of factoring over other methods of financing, non-recourse factoring has some specific benefits.

Because non-recourse factoring protects the seller, it can guard against the accumulation of bad debts, and be a reliable source of capital financing.

Reliable Cash Flow

Invoice factoring as a whole is a useful cash flow management system for many businesses. This is particularly true for businesses that have long accounts receivable cycles, such as contractors and vehicle and machinery leasing firms.

Through factoring, businesses can access almost instant cash flow, through selling their accounts receivable. This allows for better planning, budgeting, and decision making. Because businesses can turn their accounts receivable into cash at any time they wish, they can operate more confidently and competitively.

Non-recourse factoring gives businesses the highest level of surety over their cashflow. They can convert their receivable assets into working capital, without the risk of having to buy back accounts that are unmet due to insolvency.

Scope for Quicker Growth

With the globalization of markets and ideas, almost all industries are becoming increasingly competitive. In many instances, businesses are required to implement fast growth in order to retain their hold on the market.

If you have a backlog of receivable accounts, this can drastically hinder the amount of working capital available to your business—and with that, its ability to invest in growth strategies.

The low-risk nature of non-recourse factoring can give businesses the opportunity to pivot and expand operations faster than their existing counterparts.

Bad Debt Protection

One of the most apparent benefits of non-recourse invoice factoring is protection against bad debts.

Reports show that bad debt losses have been on the rise in Europe for some time. If the failure of a major debtor has the potential to adversely impact your business, non-recourse factoring can provide critical protection.

Reduced Collections Work

Another advantage of non-recourse factoring is potential reductions in collections work. Finance departments can spend vast amounts of time on collecting receivables. When accounts are passed on to a factor, the factor then assumes this workload.

Potential Drawbacks

Although non-recourse invoice factoring can be an ideal capital financing method, there are some potential drawbacks to be aware of.

These include overly high factoring fees and agreements that place undue liability on the seller. To avoid these potential pitfalls, ensure that you vet potential factors and their offers thoroughly, and select a transparent and trustworthy provider.

Do Your Research When Looking for the Best in Non-Recourse Factoring

While non-recourse factoring can be an ideal cash flow and capital financing solution for many businesses, not all factoring deals put the seller first.

Therefore, make sure you choose your factor with care, and ensure that they offer the liability protection they say they do.