Celebrating Small Business Week: Practical SBA Solutions for Growth and Stability

Background

For over six decades, National Small Business Week, hosted by the U.S. Small Business Administration (SBA), has celebrated the vital contributions of America’s entrepreneurs and small business owners. Scheduled from April 28 to May 4, 2024, this event honors their perseverance, creativity, and economic impact. ZenBusiness highlights this celebration to emphasize our commitment to supporting small businesses, aligning with the event’s goals and providing these essential resources and guidance to empower small business owners.

SBA Initiatives to Streamline Funding for Small Business Owners

Starting and growing a business can have significant financial challenges.

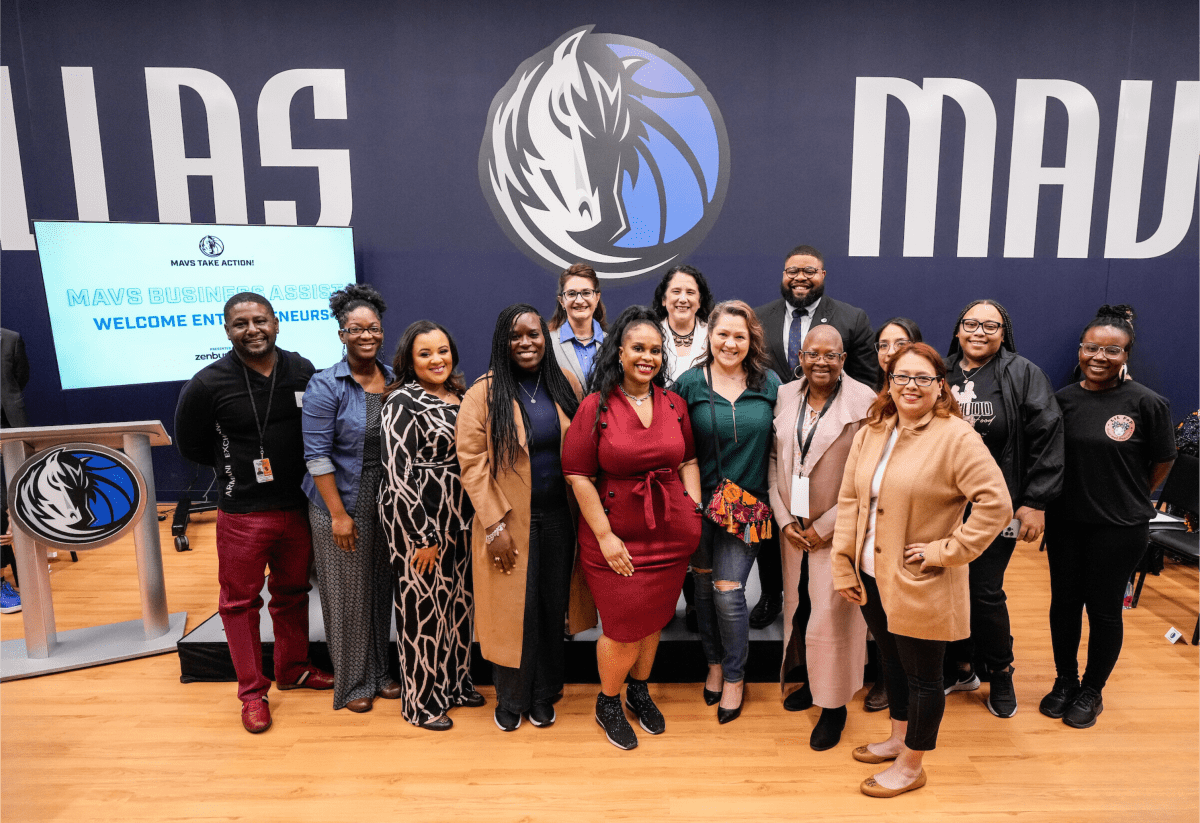

To help with these hurdles, SBA Administrator Isabel Casillas Guzman and Harrison Blair from the Dallas Black Chamber of Commerce showcased several new initiatives at the “Future of Diverse Entrepreneurship in America” event, recently held as a collaborative effort sponsored by ZenBusiness and hosted by the Dallas Mavericks Business Assist Program.

These initiatives simplify access to funding, provide targeted support, and help ensure that small business owners have the tools they need to succeed. The SBA committed to improving programs for small business owners, such as:

Increased Access to Funds

The SBA enhanced its digital offerings, such as the Lender Match tool, which helps businesses find appropriate lenders and financial aid more efficiently by focusing on simplifying the loan application process and connecting business owners with the right lenders. This program is particularly beneficial for those who have traditionally found it challenging to obtain financing due to strict credit requirements or lack of collateral.

Empower to Grow Program

The Empower to Grow program uplifts businesses to be procurement ready for federal, state, and local government contracts. This program is a reinvigoration of the former SBA 7(j) Management.

Community Navigator Pilot Program

Recognizing the importance of personalized support, the Community Navigator Pilot Program connects entrepreneurs with local organizations that offer guidance and resources tailored to their specific needs. The program offers funding to nonprofits, state and local governments, universities, and tribal entities to partner with SBA. These hubs then support spoke organizations — trusted, culturally knowledgeable local groups and individuals — who will connect to specific sectors of the entrepreneurial community to provide assistance during economic recovery.

5 Key SBA Resources to Help Fund Your Business

In addition to the new or updated initiatives, the SBA continues to offer robust loan programs designed to meet a variety of business needs:

1. 7(a) Loan Program

This versatile small business loan program helps cover operational costs, assists with debt refinancing, or funds new equipment purchases, supporting the diverse needs of small businesses at different stages of growth.

2. 504 Loan Program

Ideal for businesses planning major purchases or construction projects, the 504 small business loan program offers long-term, fixed-rate financing. This is especially valuable for entrepreneurs looking to purchase real estate or invest in significant facility upgrades.

3. Microloan Program

The Microloan program is tailored for smaller-scale financial needs, offering loans up to $50,000. It’s perfect for startups and newer businesses needing a financial boost to get off the ground or expand modest operations. It’s important to note that each intermediary lender has its own lending and credit requirements. Intermediaries may require some type of collateral as well as the personal guarantee of the business owner.

4. Lender Match Tool

The SBA’s Lender Match tool goes beyond traditional lending by connecting businesses with a network of SBA-approved lenders. This tool simplifies the process of finding suitable financing options, making it quicker and easier for small businesses to get the funding they need.

5. Community Advantage Loans

These loans focus on providing financial opportunities to small businesses in underserved areas, helping ensure that all entrepreneurs have access to necessary resources for growth and success.

New ZenBusiness Customer? Apply for Our Grant!

ZenBusiness offers an exclusive grant program for our recent customers seeking additional funds to launch or expand their businesses. This initiative is designed to provide financial support specifically tailored to the needs of new small business owners who have just started their journey with us. To learn more about the availability of these grants and to check your eligibility, please visit ZenBusiness Grants.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.