Don't do it alone.

Our goal is to make business easy. We’ve got experts available by phone to answer questions, 7 days a week. Let us handle the details so you can focus on what you do best.

Contact us

Let us help with ongoing state compliance filings tokeep you in good standing.

$199/yr and keeps your business protected

*The listed affiliate partners will earn commissions if you purchase through links on their website.

Rest easy with our Worry-Free Compliance service, which sends alerts to notify you of upcoming compliance and filing events. Plus it covers your annual report and up to two business amendment filings per year.

We know keeping track of business documents and ongoing compliance requirements can be a big headache for businessowners who just want to manage and grow their company. That’s why we pioneered our Worry-Free Compliance service.

| Feature | Basic $99/yr | Essential $199/yr | Advanced $299/yr or $99 add-on |

|---|---|---|---|

| Email reminders and alerts | ✓ | ✓ | ✓ |

| Compliance calendar | ✓ | ✓ | ✓ |

| Compliance score | ✓ | ✓ | ✓ |

| Meeting minutes wizard | ✓ | ✓ | ✓ |

| Annual report filing | ✕ | ✓ | ✓ |

| Amendment filings | ✕ | 2 per year | Unlimited |

| Certificate of good standing | ✕ | ✕ | 1 per year |

| Premium compliance support | ✕ | ✕ | ✓ |

| Money-back on penalties | ✕ | ✕ | ✓ |

| 24/7 AI-Powered Compliance Monitoring* | ✕ | ✕ | ✓ |

| Worry-Free Money-back Guarantee** | ✕ | ✕ | ✓ |

1. Advanced can be purchased as a $299/yr plan or as a $99/yr add-on to eligible plans.

2. “Unlimited” refers to the number of amendment filings included per year- excluding the state filing fee.

3. State fees are not included.

*ZenBusiness will proactively monitor all federal and state-level regulatory changes of general applicability which may impact LLC owners and will notify the customer of any changes which may impact their LLC, excluding professional, occupational, or business-specific licensing and permitting requirements.

**As long as you maintain Worry-Free Compliance, complete required actions, and keep your state fees up to date, ZenBusiness has your back and offers our money-back guarantee. If your business receives a state fine related to a covered compliance filing, we’ll take care of paying it. Covered compliance filings include annual reports and amendment filings. If these filings cannot be completed on time because of your inaction or error, this guarantee will not apply.

Worry-Free Compliance Service

Registered Agent Service

Purpose

Helps businesses stay compliant with state regulations by sending reminders and filing annual reports and amendments on behalf of the customer.

Fulfills legal requirement with the state; acts as the point of contact for official legal mail and receives and forwards important documents to the business owner.

Benefits of Service

Helps businesses stay compliant with state regulations, saves time and effort, and reduces the risk of fines and penalties.

Prevents you from being served with notice of a lawsuit in front of customers; allows you to freely leave the office instead of being required to stay in the office during normal business hours, as is required for registered agents.

Includes

Annual report filings and two free amendment filings every year.

Receiving and forwarding official legal mail, scanning and uploading documents to the customer’s dashboard, and notifying the customer via email.

Excludes

State fees and filing of beneficial ownership information.

Filing of annual reports, amendments, and other state-specific requirements.

How it works

Sends reminders and files annual reports and amendments on behalf of the customer.

Receives and forwards official legal mail and documents to the customer’s dashboard.

Renewal

Automatically renews annually.

Automatically renews annually.

Cancellation Policy

Cancel at any time.

Cancel at any time; requires a new registered agent to be appointed or the business to be dissolved.

Pricing

$199/year (first year free)

$199/year

Don't do it alone.

Our goal is to make business easy. We’ve got experts available by phone to answer questions, 7 days a week. Let us handle the details so you can focus on what you do best.

Contact us

Our Worry-Free Compliance service helps you stay on top of ongoing state requirements – without having to track everything yourself. It includes:

Plus, with our Worry-Free Compliance guarantee, if your business receives a state fine solely because ZenBusiness missed a covered filing deadline, we’ll pay it — as long as required actions and state fees are up to date.

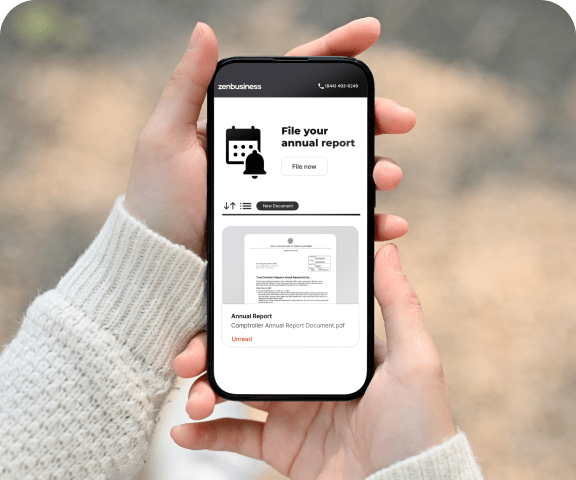

We will proactively alert you of upcoming annual or biennial report compliance events so you never miss these important deadlines. We monitor your status with the state to help ensure your business remains in good standing.

Business compliance means following your state’s rules so your business can stay active and in good standing. These rules can include things like filing required forms on time and keeping your business information up to date with the state.

Every state has slightly different requirements. For example, most states require an annual report filing that updates your company’s basic details.

If you use ZenBusiness Worry-Free Compliance, we help you stay compliant by tracking deadlines and filing your annual report for you when it is required by your state.

An annual report is a filing most states require every year to confirm your business’s information and report any changes. Even if nothing has changed, you usually still need to file it to keep your business in good standing.

The due date for an annual report depends on your state. If you have Worry-Free Compliance with ZenBusiness, we will file your annual report for you each year.

A business amendment is a filing you submit to the state when you change key details of your business, such as your business name or ownership information. States require you to file these changes to keep your business records accurate and in good standing.

With our Worry‑Free Compliance service, we cover the preparation and filing of up to two amendments per year for your business. You just need to approve the changes and pay any required state filing fees.

In the unlikely event you fall out of good standing for missing a state-required filing like an annual report, then we will provide a detailed action plan and help you get back in good standing.

Most frequently, compliance refers to adhering to the laws for your business type and industry. An LLC might be required to file an annual report with the state government every year and pay a corresponding fee. A publicly traded corporation will need to follow the rules set forth by the U.S. Securities and Exchange Commission. A restaurant would need to follow national, state, and local laws for proper handling of food. A company with employees will need to follow federal and state labor laws.

You could divide compliance in business into four categories:

A business not in compliance could face heavy fines or be shut down altogether by the government. A business like an LLC or corporation could lose the personal liability protection for its owners if the state dissolves it, leaving the owners’ personal assets at risk from lawsuits against the business.

Recommended read: E-Verify: Government Contractors Must Verify Employees Right to Work Through E-Verify.

Worry-Free Compliance is ZenBusiness’s ongoing service that helps keep your business in good standing by monitoring key state and federal requirements for you.

It brings everything together in one place — showing you where your business stands, reminding you of important deadlines, and helping you complete required filings on time. You’ll get a clear view of your compliance status, guided tools for required documentation, and support with common filings like annual reports and amendments.

Worry-Free Compliance is offered with the Starter package 50% off for the first year, and is included in both Pro and Premium packages.

With the Starter package, the first year costs $99 and renews at $199 per year.

The Worry‑Free Compliance service includes email reminders for annual reports, help with filing annual reports, and two free amendments each year.

Yes, you can cancel Worry-Free Compliance after the first year. If you cancel, you are still responsible for paying any state fees for required filings you choose to make on your own.

No, the Worry-Free Compliance service does not cover tax filings. You can purchase tax advisory services separately through your ZenBusiness Dashboard.

Yes, you can add the Worry-Free Compliance service to an existing business. Simply add Worry-Free Compliance to your ZenBusiness account for that business, and our team will handle the compliance support going forward.

The Worry-Free Compliance service sends email reminders about upcoming annual reports and handles the filing of these documents on your behalf once you place your order. This helps ensure that your business stays in good standing with the state.

If you don’t renew Worry-Free Compliance after the first year, you’ll be responsible for handling your annual reports and other required compliance filings on your own.

You’ll also lose access to the free amendment credits that are included with Worry-Free Compliance.

Even without a renewal, you can still purchase our annual report service separately if you want ZenBusiness to file your annual report for you.

No. You must purchase a separate Worry‑Free Compliance service for each business. Every business entity needs its own Worry‑Free Compliance subscription tied to that specific company.

No, the Worry-Free Compliance service is not required for your business. However, it can help ensure that your business stays compliant with state requirements and avoids any late fees or penalties.

Ready to Start Your LLC?