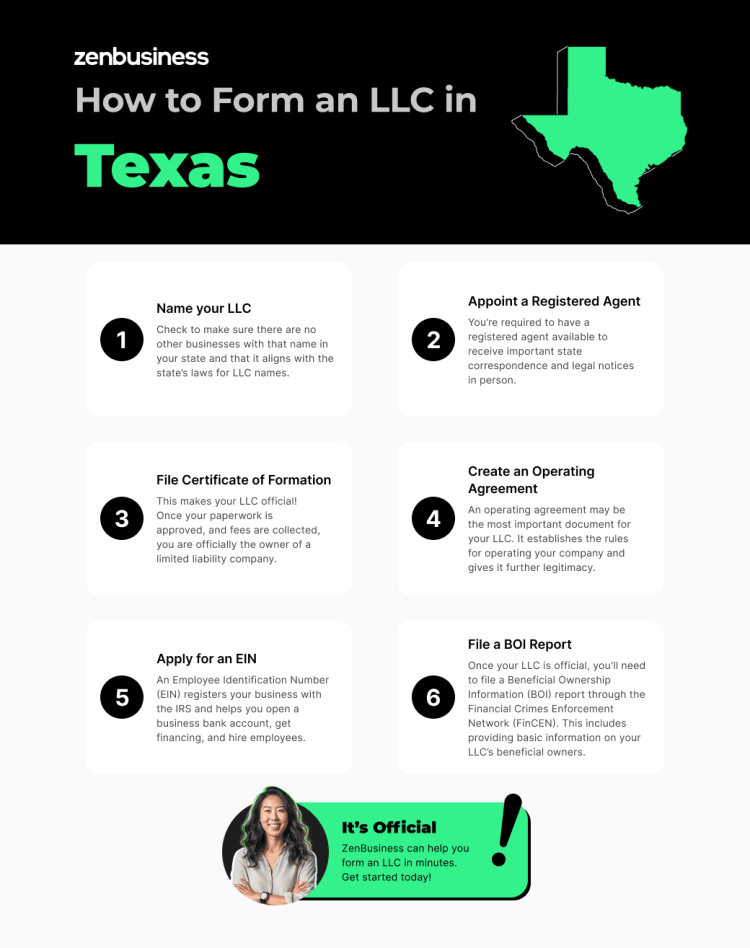

Form a Texas LLC in 6 steps: choose a name, appoint a registered agent, file Form 205 Articles or a Certificate of Organization with the Secretary of State, create an operating agreement, obtain an EIN, and secure required licenses and permits.

Starts at $0 + TX state fee and only takes 5-10 minutes

Last Updated: March 2, 2026

Want to launch your business as an LLC? Texas is a business-friendly state, just as the limited liability company (LLC) is a business-friendly concept. It allows entrepreneurs to have liability protection without the cumbersome structure of a corporation. It’s sort of like getting the best plate of barbecue in town without having to wait in a long line.

Still, forming a Texas LLC requires you to follow certain steps and meet certain requirements, which can be scary if you’ve never started your own business before.

The Texas Secretary of State has a few rules to follow if you want to form your limited liability company smoothly, quickly, and without costly fines. To show you how to start a Texas LLC, we’ve put together six basic steps (think of it as the Texas Two-Step plus four):

Choosing a unique and compliant name is the first step in forming your LLC in Texas. It must be different from any other existing business name in the state. It must also follow Texas limited liability company naming guidelines.

Here’s a simplified guide to help you with the naming process of your Texas LLC:

For a more detailed understanding of the naming rules and to review the state’s naming guidelines, visit the Texas Secretary of State website.

Texas doesn’t have many restrictions for naming a professional limited liability company (PLLC). However, the name should include the designator “professional limited liability company” or the abbreviation “PLLC” or “P.L.L.C.” You also need to ensure that your name doesn’t violate any of the ethics requirements in place within your industry. From there, ensure that your name isn’t similar to the names of other businesses in Texas. A preliminary search on the Texas Business Search page can help check availability.

You can change the legal name of your LLC in Texas at any time (so long as another business is not using the new name). To do so, you’ll need to file a Certificate of Amendment with the Secretary of State, which you can do through the Texas SOSDirect website or by mail. The Certificate of Amendment has a filing fee.

If you want to call your business something new but don’t care much about your LLC’s legal name, filing an Assumed Name Certificate will be far more cost-effective. This form costs a smaller fee to submit and enables your company to interact with the public under a different name than its official one.

Next, designate a registered agent for your business. The government has to be able to reach your LLC. They need a contact (an individual or business entity) and a Texas street address for your business so they can send official government correspondence, tax forms, and legal documents, such as a summons if the business is sued.

This contact person or business entity is called the “registered agent” in Texas. The official registered agent address for your business is called the “registered office.” The registered office doesn’t have to be where your business is actually located, but it does have to be a physical street address in Texas. You can’t use a P.O. box because notices like subpoenas must be delivered in person.

So, who do you choose to be your registered agent? You have three options here. You can be your own registered agent, appoint another person as your agent, or use a registered agent service. A few states will allow an LLC to be its own registered agent, but not Texas.

Filing your Certificate of Formation (Form 205) with the Texas Secretary of State is the pivotal step to officially register your LLC in Texas. This document is known as the “Articles of Organization” in many other states.

To file/apply online, visit the Texas Secretary of State website and create an SOSDirect Account. The filing fee is a one-time payment of $300, with an additional 2.7% charge for credit card payments. The processing time for online filing varies but is typically 10 to 12 business days.

For those preferring to file by postal mail, the same fee of $300 applies. Complete the Certificate of Formation form and mail it along with the payment to:

Secretary of State

P.O. Box 13697

Austin, TX 78711-3697

Filing by postal mail is considerably slower, with an estimated processing time of 70 to 72 business days. Although slower, this method is an alternative for those who aren’t comfortable filing online.

Once filed and approved, you’ll receive a stamped Certificate of Formation from the state, officially recognizing your LLC. If any information in the Certificate of Formation changes in the future, you must inform the state about these updates.

If you’re forming a PLLC in Texas, you’ll use a slightly different form, Form 206, Certificate of Formation for a Professional Limited Liability Company.

The “governing authority” refers to the management structure of your LLC, indicating whether it’s managed by the members/owners (member-managed) or by a designated manager (manager-managed). Member-managed is commonly chosen when there are only a few owners who actively run the business.

Creating an operating agreement, although not mandated by Texas law, is a crucial step, especially if your LLC has multiple owners. This document outlines the operational rules, roles, and financial arrangements within your LLC, promoting clarity and preventing future disputes. It’s a testament to the flexibility that the LLC structure offers, allowing you to tailor the agreement to suit your business’s unique needs.

Here are the key components you may consider including in your Texas LLC operating agreement:

If you’re unsure about how to create an operating agreement, numerous online resources and legal professionals can provide guidance or templates to get you started. The operating agreement can be amended as needed with the consent of the LLC members, ensuring it evolves with your business needs over time.

Why it matters: Texas banks and other financial institutions may require an operating agreement—along with your EIN letter and Certificate of Formation—when opening a business checking account or seeking financing. Having the signed document ready can prevent delays.

Acquiring an Employer Identification Number (EIN) from the IRS is like getting a Social Security number for your LLC, and it’s free. You can easily apply online on the IRS website for a quick response. If you prefer mail, send your application to: Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999, though it’ll take about four weeks.

Most LLCs need an EIN for the following reasons:

Even single-member LLCs without employees may require an EIN for certain business licenses and permits.

Quick Note: Despite its name, an EIN isn’t just for employers. And don’t mix up the EIN with the 11-digit Taxpayer Number from the Texas Comptroller, which we’ll discuss next.

Once your Texas LLC is in the books, you’ll receive the Franchise Tax Responsibility Letter (Form 05-280) from the Texas Comptroller of Public Accounts in about two to three weeks. This letter furnishes an 11-digit Taxpayer Number for your LLC’s state taxes and briefs you on the Texas Franchise Tax, levied for the privilege of doing business in the state.

The annual franchise tax report in Texas is a report that must be filed annually by LLCs in Texas.

There’s a very good chance that your Texas LLC will need at least one license or permit. But it’s not quite as simple as saying, “File this form with the Texas Secretary of State.” For this step, you’ll need to do a little bit of research.

For starters, some LLCs need to get federal licenses. For example, businesses that manufacture alcoholic beverages would need to get a license from the Alcohol and Tobacco Tax and Trade Bureau. Meanwhile, businesses in aviation would need to get a license from the Federal Aviation Administration. If your LLC involves a heavily regulated activity, there’s a good chance you’ll need a federal license.

Next, you’ll have to check state-level licenses. Unlike some states, Texas doesn’t have a general business license that applies to every single business. But you will need to get a sales tax permit from the Texas Comptroller if you’re selling goods or services that are subject to state taxes.

You’ll also have to address local licenses at the county or city level. Even though Texas doesn’t have a general business license, your municipality might. These requirements vary a lot, though. For example, El Paso requires a general business license at the city level, but Houston doesn’t. You’ll have to check with your city government to know if your city requires one. It’s also likely that you’ll need to get zoning permits, too.

Last but not least, you’ll need to research licenses for your industry or profession. For example, LLC owners who are massage therapists, barbers, driver’s education teachers, and others all need to get licenses administered by the Texas Department of Licensing and Regulation. Lawyers need licensure from the state bar, while medical professionals need licensure from the Texas Medical Board. And the list could go on.

Long story short: you’ll need to do plenty of research to ensure you get all of the licenses that apply to your unique business — your unique industry, services, and business location. .

Licenses and permits take on prime importance in a PLLC, so please check with the Texas Business Permit Office’s website to see if your professional LLC requires specific licenses. There may also be local permits or occupational licenses needed in the city or county where you operate. Use business license report services to ensure you get all necessary permits and licenses.

Once you’ve rounded up the process of forming your LLC in the Lone Star State, there are several essential steps you should consider to help ensure your business rides smoothly. Let’s explore these important aspects.

Once you’ve formed your LLC and secured an EIN, you’ll be able to open a business checking account. Having your operating agreement ready speeds up the process. Having separate accounts for your business and your personal banking is critical for sorting out your finances at tax time. It helps you avoid commingling funds.

Commingling funds not only makes your taxes more difficult, but it could also be used against you if someone takes you to court to challenge whether you and your LLC are truly separate entities.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC.

After the celebration of establishing your LLC, it’s crucial to keep an eye on those calendar dates. In Texas, LLCs are required to file an annual report called a “Public Information Report” in association with the Texas annual franchise tax. This isn’t just a one-time task but a yearly responsibility.

Why is this so essential for your LLC? The annual report keeps the state updated about key aspects of your business, such as management structure and operational insights. Not only is it legally mandated, but it also ensures you maintain a good standing with the state authorities. Missed deadlines can lead to penalties or, worse, the dissolution of your LLC.

Insuring your LLC with appropriate business insurance is a prudent step to mitigate risks. Here are some common types of insurance you might consider:

Each insurance type serves a different purpose, and the right mix for your LLC depends on the nature of your business. For more detailed information on business insurance options, consult with an insurance advisor or visit the Texas Department of Insurance website.

Opting for an S corp status could provide tax advantages by allowing you to split your income into salary and company profits, potentially lowering your self-employment taxes. However, S corps are closely scrutinized by the IRS and have specific qualification criteria. It’s recommended to consult with a tax professional to understand the implications and benefits of S corp status for your Texas LLC. For a more in-depth exploration of S corp status, benefits, and qualification criteria, visit the IRS website or consult with a tax advisor.

With Texas’s vast opportunities come changes in regulations, business trends, and networking possibilities. Engage with local business groups, chambers of commerce, or even online forums that cater to Texas entrepreneurs. This not only keeps you updated with the latest in business laws but also provides an excellent opportunity to network and grow.

Your LLC journey in Texas is more than just formation. It’s about growth, stability, and ensuring that your business dream doesn’t just survive but thrives.

Choosing an LLC structure in Texas isn’t just about following a trend; it’s a strategic move. The state’s business-friendly environment, coupled with the inherent advantages of an LLC in Texas, offers numerous perks. Here’s a closer look at why one might opt for one in Texas:

At the heart of an LLC is the protection it offers. When you form an LLC, your personal assets (like your home, car, or personal bank accounts) are usually shielded from business debts and lawsuits. In the event that your Texas LLC faces financial hardships or legal disputes, your personal belongings are usually safe.

Here’s a Texas-sized benefit — flexibility in how your LLC is taxed. You can choose between being taxed as a sole proprietorship, partnership, or Texas corporation. But there’s a cherry on top: Texas doesn’t slap a state income tax on LLCs. So, while you’re enjoying your BBQ, you can also relish the fact that you’re keeping more of your hard-earned money.

Anyone who’s looked at setting up a corporation knows that the paperwork can be thicker than a Texas T-bone steak. With an LLC, you’re in for a leaner experience. The administrative process is more straightforward, which is a godsend for budding entrepreneurs eager to get their business off the ground without drowning in red tape.

Sure, “John’s Barbecue” has a nice ring to it. But “John’s Barbecue, LLC” just sounds more official, doesn’t it? Those three letters, “LLC,” can add a layer of professionalism to your business. It signals to customers, suppliers, and partners that you’re serious about your business.

Texas allows you to structure your LLC’s management the way you want. Whether you prefer member-managed or manager-managed, the choice is yours. This adaptability helps ensure that you can operate your business in a manner that best fits your vision and goals.

One of the unique features of Texas law is the strong protection of assets. For instance, Texas offers robust homestead protections, meaning your primary residence is typically safeguarded from creditors.

With its booming economy, diverse industries, and thriving cities like Austin, Dallas, and Houston, Texas presents vast opportunities for business growth. Being an LLC in such a dynamic state means you’re well-positioned to capitalize on these opportunities.

In Texas, as the saying goes, “Everything’s bigger.” And that includes the benefits of setting up an LLC. Whether you’re a local or someone looking from the outside in, Texas provides a fertile ground for your business dreams to take root and grow.

Everything’s bigger in Texas, including the business opportunities. Across the sprawling plains, from the urban hustle of Houston to the serene landscapes of the Hill Country, Texas provides diverse options for entrepreneurs. Let’s explore the types of LLCs the Lone Star State offers:

Picture a lone ranger, galloping across the vast Texan landscapes with a vision and determination to carve out a niche in the business world. For those individual trailblazers looking to harness the benefits of an LLC without sharing the reins, a Texas single-member LLC is the perfect fit. It grants you the freedom of solo entrepreneurship with the shield of limited liability, helping your personal assets stay secure amidst the business rodeo.

Just as a group of cowboys makes a round-up smoother, a multi-member LLC is designed for teams. Whether it’s a dynamic duo or a larger posse of partners, this structure allows members to pool their resources, skills, and visions. Every member gets a seat around the campfire, sharing the profits, losses, and decision-making, helping ensure collaborative growth in the Texan business frontier.

The Texas series LLC is a forward-thinking structure that the state offers. Imagine a ranch with multiple herds, each distinct yet part of the same property. Similarly, a series LLC lets you operate several distinct LLCs under one overarching master LLC. Each “child” LLC can manage its finances, members, and operations while being protected from the liabilities of the other LLCs in the series. It’s an excellent setup for entrepreneurs with diverse interests and ventures.

A professional limited liability company (PLLC) is a business entity tailored for licensed professionals, such as doctors and lawyers. Its primary purpose is to provide liability protection, similar to a regular LLC, while also meeting professional licensing requirements. Note that a PLLC doesn’t shield its members from personal malpractice claims. It can, however, protect the members from malpractice claims against the other members.

An LLC isn’t the only business structure available in Texas. Here are some others:

Sole proprietorship: This is the simplest business structure. It’s composed of only one person and requires no registration with the state unless you want a DBA. You’ll need a DBA if you want to operate your business under any name other than your surname. The problem with sole proprietorships is that they offer no liability protection for your personal assets. If someone sues the business, they can go after your personal savings, home, car, etc.

General partnership: A general partnership operates like a sole proprietorship, but it has multiple owners. Like a sole proprietorship, it offers no personal liability protection.

Corporation: Like an LLC, this structure exists apart from its owners. It offers the strongest liability protection. However, corporations are subject to “double taxation,” in which profits are taxed twice, once at the corporate level and again when they’re distributed to the individual shareholders as dividends. Corporations also have more formalities and red tape than other business structures, such as keeping corporate records and having shareholder meetings.

Limited partnership (LP): An LP is a type of partnership where there is at least one general partner who operates the business but has unlimited liability for any business debts; the limited partners only have liability up to the amount they’ve invested in the business.

Limited liability partnership (LLP): An LLP is similar to an LP, except that all of the partners have limited liability; there are no general partners with unlimited liability. In an LLP, partners also have liability protection from the errors of other partners. Unlike LLCs, LLPs require that management duties be equally divided among the partners. LLPs are often used by professionals like lawyers and doctors.

Once you’ve finished the steps above, you’re (literally) in business! You’ve taken the first steps to building your dream company. But there’s a lot more to know than just how to start a Texas LLC.

You need to know about things like hiring employees, getting business licenses and permits, getting additional business financing if you need it, how to make changes in your business, and how to stay in compliance with the government.

Our many business formation services can not only help you form your LLC, but our business experts can also give you long-term business support to help start, run, and grow your business. In other words, it’s not our first rodeo.

So, if starting an LLC in Texas feels like putting socks on a rooster, we can help. Let us take care of formation, compliance, and more. That way, you can get back to running your dream business, whether it’s a tourism agency in Corpus Christi or a food truck in Austin.

Related Topics

TX LLC FORMATION THAT'S FAST AND SIMPLE

Take it from real customers

To dissolve an LLC in Texas, you’ll need to submit a Certificate of Termination to the Secretary of State. This form can be submitted through the SOSDirect website or by mail, with an associated fee.

However, you can’t submit a Certificate of Termination without first getting proof that your business’s tax obligations are fulfilled in the state of Texas. You’ll need to apply for and receive a Certificate of Account Status from the state comptroller’s office before you can officially terminate your business. When terminating your LLC with the Secretary of State, you’ll be asked to append this document to your forms.

Yes, you can change your LLC’s mailing address on the Texas Comptroller’s website.

There’s no fee for changing your LLC’s mailing address.

You can list something like a P.O. box as your LLC’s mailing address, but you’re still required to have a registered agent with a physical street address to form your LLC.

The most inexpensive way to start an LLC in Texas is to file the Certificate of Formation yourself directly with the Texas Secretary of State and pay the mandatory $300 state filing fee. You can also obtain your EIN directly from the IRS at no cost. Beyond the state filing fee, your main additional costs will depend on whether your business requires specific licenses or permits.

Many states don’t permit professionals from different fields to form a professional LLC together. However, Texas does permit joining practices by certain professionals. For example, doctors of medicine and doctors of osteopathy may jointly form and own a PLLC. For a full list of permissible joint practices, visit sos.state.tx.us.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. For specific questions about any of these topics, seek the counsel of a licensed professional.

Start an LLC in Your State

Ready to Start Your Texas LLC?